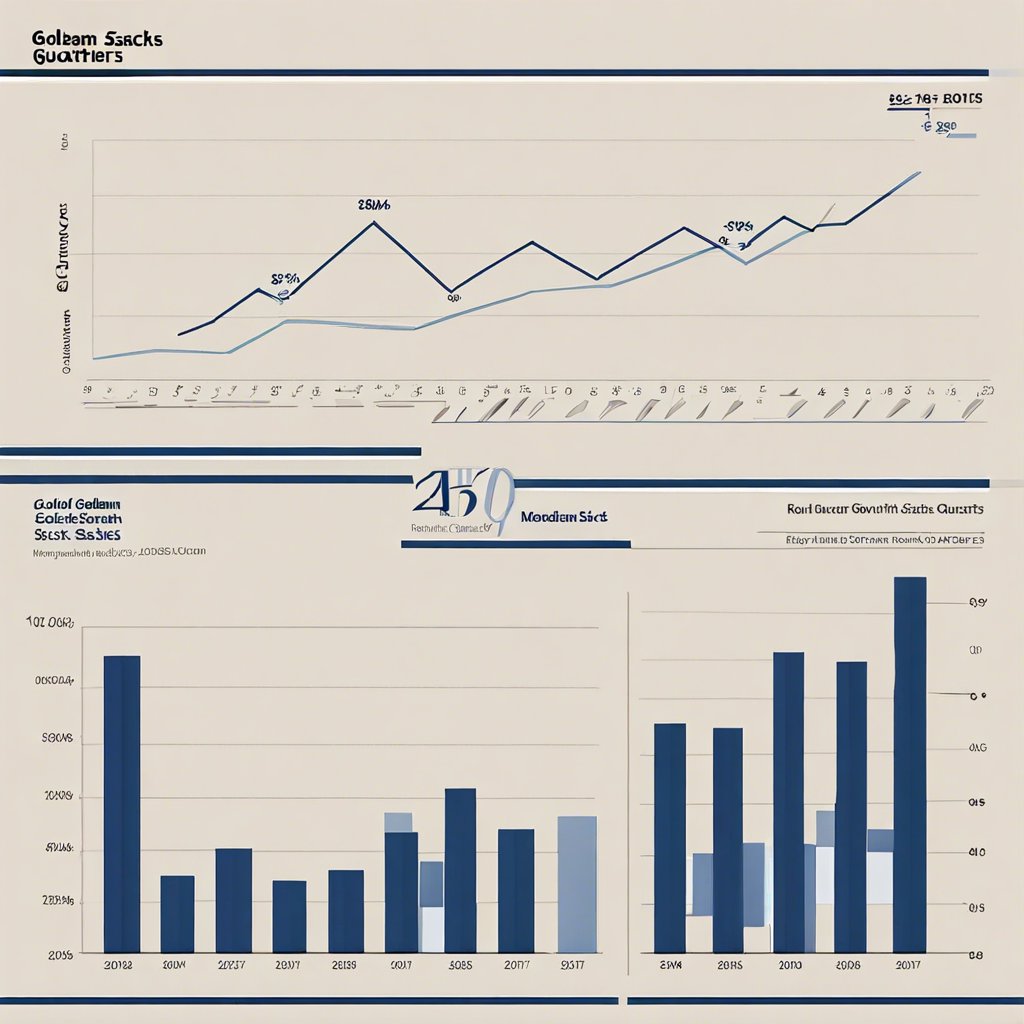

Goldman Sachs reported a significant increase in profits for the second quarter, amounting to $3 billion. Despite challenges in traditional business areas like mergers and acquisitions and trading due to high interest rates and inflation concerns, the elite investment bank managed to perform impressively.

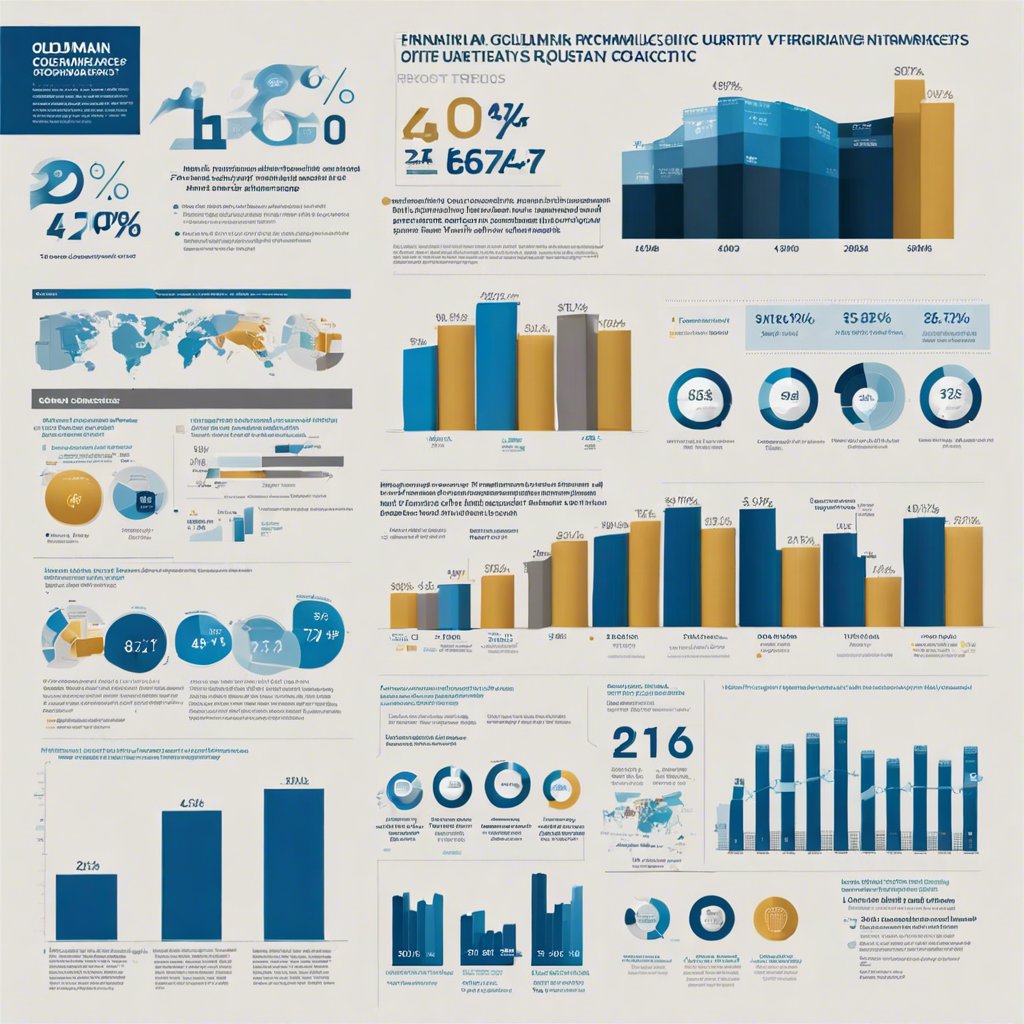

Financial Performance

Goldman Sachs showcased strong performance across its various segments, with a focus on asset management which now oversees nearly $200 billion. The bank’s stock has surged by almost 47% over the past year, reflecting its positive trajectory.

Impact on Wall Street

Goldman Sachs’ strategic revamp, including staff reduction and a shift towards asset management, has implications for the broader financial industry. The bank’s involvement in ventures like Apple’s credit card and discussions for potential exits demonstrate its adaptability.

Challenges and Comparisons

While Goldman’s overall performance was robust, it faced slight setbacks in comparison to competitors like JPMorgan Chase in certain areas like merger advisory fees. The bank’s continuous evolution in response to market dynamics underscores the competitive landscape within the industry.

Economic Insights

Goldman’s decisions, such as divesting office space-related loans and expanding into private credit, offer insights into current economic trends. The bank’s expansion in private credit, despite associated risks, aligns with industry trends and indicates a proactive approach to evolving market conditions.